stock option sale tax calculator

Incentive stock option. Get unlimited free online stock ETF and option trades with no trade or balance minimums Footnote.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

When calculating your return on investment use our after-tax rate of return calculator to accurately determine your return on investments.

. Choices when exercising options. Example of an Incentive Stock Option Exercise. So if you have 100 shares youll spend 2000 but receive a value of 3000.

Taxes for Non-Qualified Stock Options. Stock futures are contracts where the buyer is long ie takes on the obligation to buy on the contract maturity. Like standard stock options they come with a strike price This often allows the option holder to buy the underlying stock at a discount.

Rather it is taxed when the stock is sold. See About Stock Options for more information. That means youve made 10 per share.

Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. Futures and options are the main types of derivatives on stocks. The underlying security may be a stock index or an individual firms stock eg.

A stock derivative is any financial instrument for which the underlying asset is the price of an equity. The difference in proceeds. Unlike standard stock options ISOs have a vesting period that prevents them from being exercised for a time as an incentive for the employee to stay with the company.

For regular income tax purposes the spread or bargain elementthe difference between the price paid and market value of the stockis not taxed when the option is exercised. An option that allows an employee to purchase stock of the employer below current market price. Lets assume your stock paid 100 in dividends which you then paid tax on via Form 1099-DIV.

Exercising your non-qualified stock options triggers a tax. The options are exercised. Exercising a stock option means purchasing the issuers common stock at the price set by the option grant price regardless of the stocks price at the time you exercise the option.

Offer or solicitation for the purchase or sale of any security financial instrument or strategy. You can now adjust your basis upwards. 1050 100 new basis of 1150.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Credit Card Interest Calculator Excel Template New Relocation Expenses Worksheet Printable Worksheets And Label Templates Excel Templates Printable Worksheets

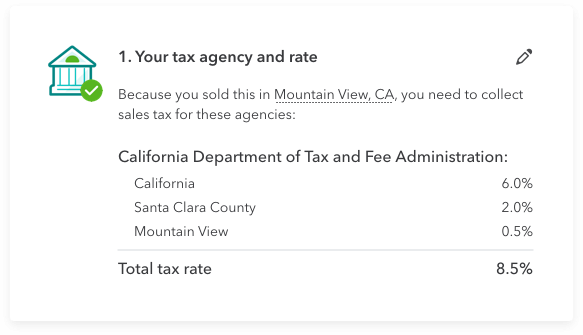

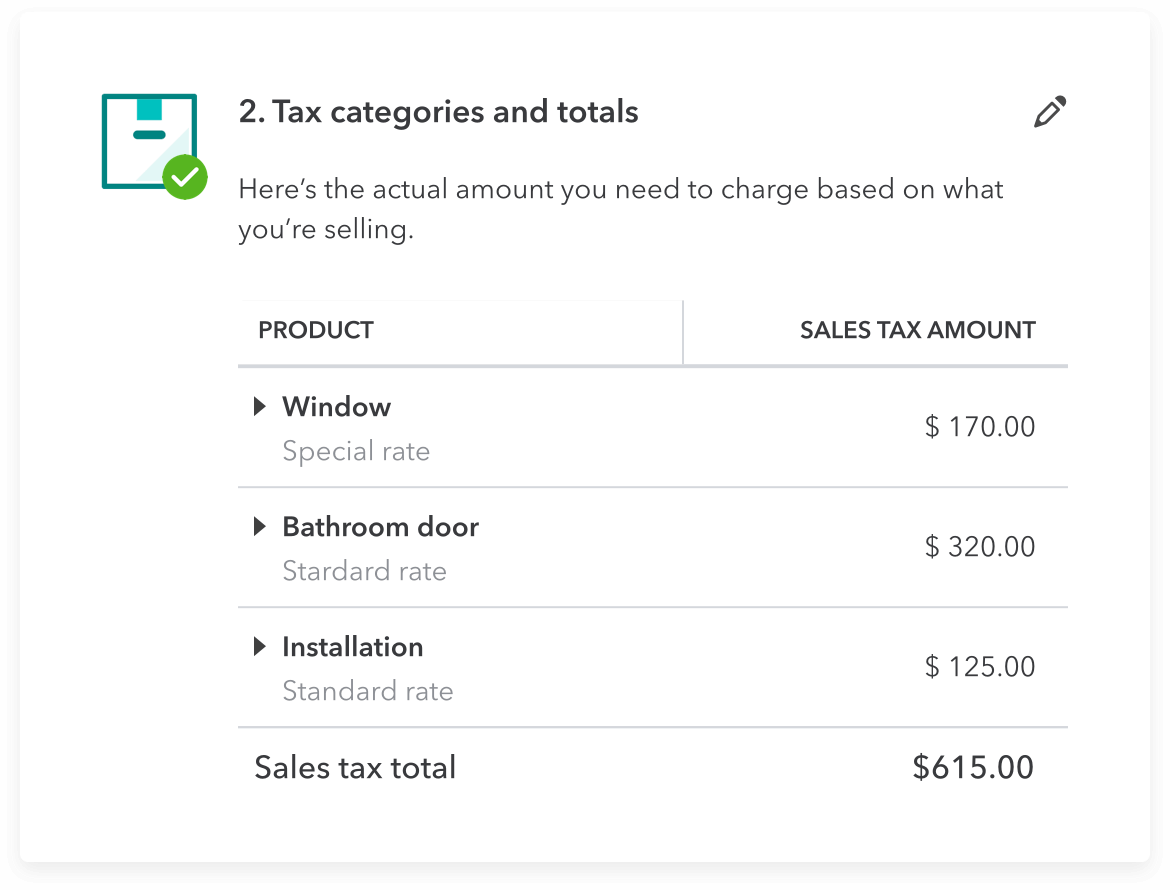

Learn How Quickbooks Online Calculates Sales Tax

How To Calculate Cannabis Taxes At Your Dispensary

Printable Yard Sale Checklist Yard Sale Garage Sale Tips Garage Sale Printables

Garage Sale Calculator Inventory List And Item Tracker Table Garage Sales Spreadsheet Excel Templates

Garage Sale Calculator Inventory List And Item Tracker Table Garage Sales Spreadsheet Excel Templates

Operation E Commerce A Game Of Disecting The Best E Commerce Software Zippycart Com Ecommerce Infographic Infographic Marketing Social Media Infographic

Locating And Discovering Sales Tax Medical Icon Sales Tax Medical

How To Calculate Cannabis Taxes At Your Dispensary

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Bc Income Tax Calculator Wowa Ca

How Stock Options Are Taxed Carta

How Do Sales Costs Of Dsts Compare With Traditional Real Estate Investing Corporate Bonds Selling Real Estate

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Calculate Sales Tax Video Lesson Transcript Study Com