tax break refund date

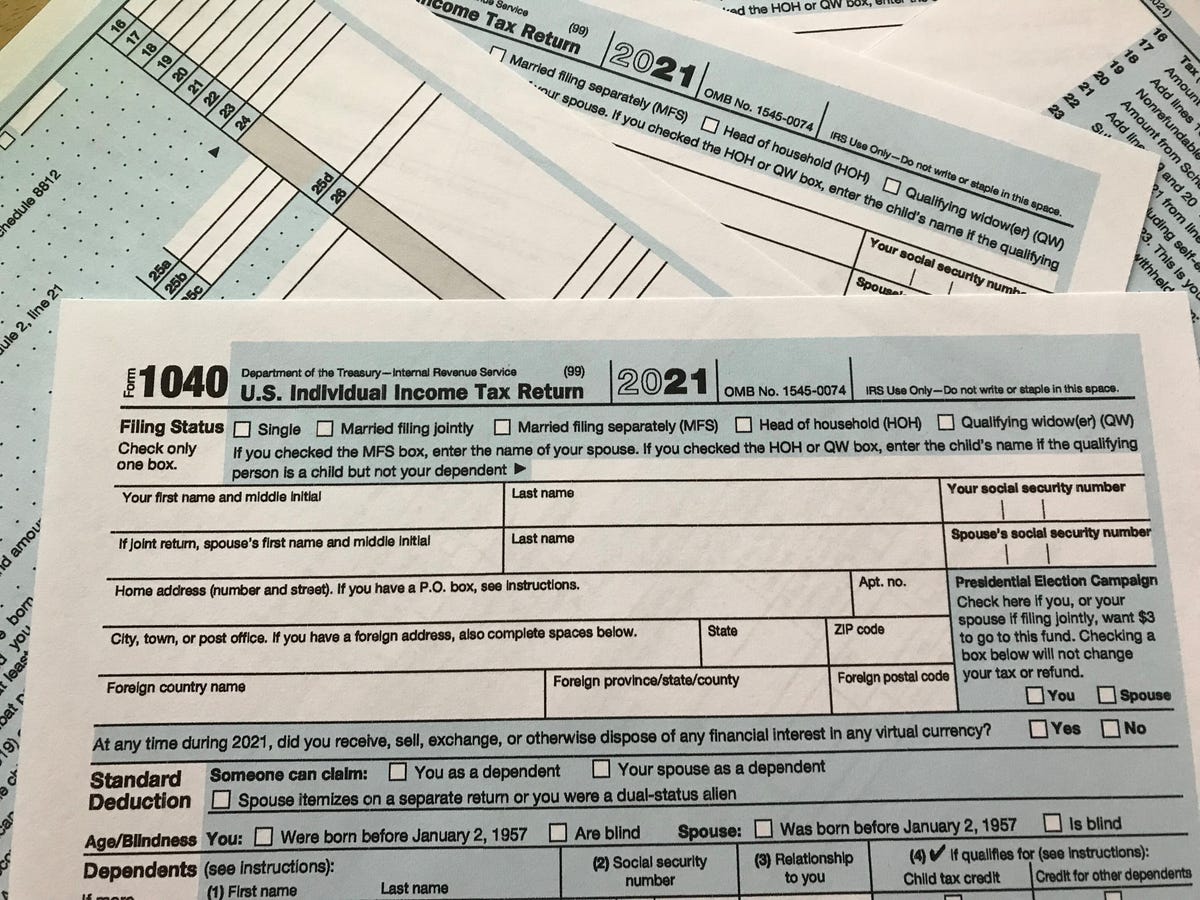

If youre due a refund from your tax return you should wait to get it before filing Form 1040-X to amend your original tax return. Unemployment Tax Break Refund How Much Will I Get.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Refund for unemployment tax break.

. The 10200 is the amount of income exclusion for single filers not the amount of the refund. Its taking us more than 21 days and up to 120 days to issue refunds for tax returns with the Recovery Rebate Credit Earned Income Tax Credit and Additional Child Tax Credit. Ad See How Long It Could Take Your 2021 Tax Refund.

Check For The Latest Updates And Resources Throughout The Tax Season. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. The amount of the unemployment tax break depends on your filing status.

Learn How Long It Could Take Your 2021 Tax Refund. Married couples filing jointly can deduct up to 30200 from their incomes. This is the latest round of refunds related to the added tax exemption for the first 10200 of.

The date you get your tax refund also depends on how you filed your return. This caused millions of taxpayers to file tax returns paying the taxes due by that date. 22 2022 Published 742 am.

By Anuradha Garg. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. The Republican Kemp persuaded lawmakers to approve paying 11 billion in one-time refunds out of Georgias historic budget surplus.

Those who choose direct deposit can receive their refunds even. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Dont file a second tax return.

The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020. Although some states add state taxes to the benefits Minnesota issued a tax exemption just as the federal government did. More than 10 million people who lost work in 2020 and filed their tax returns early.

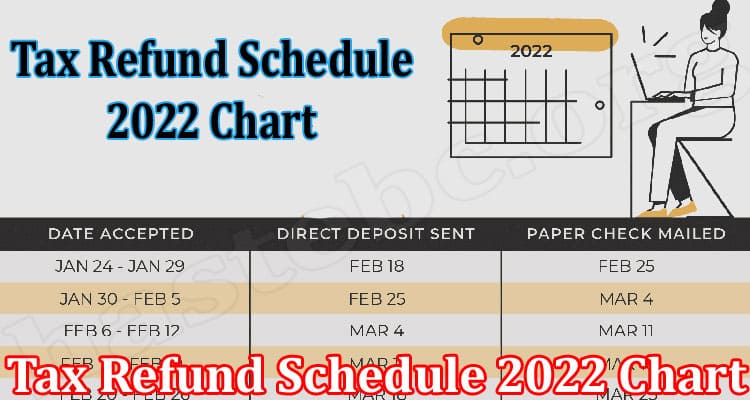

If its been longer find out why your refund may be delayed or may not be the amount you expected. So in theory if you e-file your tax return on the starting day of January 27 th 2022 you should receive your tax refund by February 16 th or a paper check between March 9th and March 23rd. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

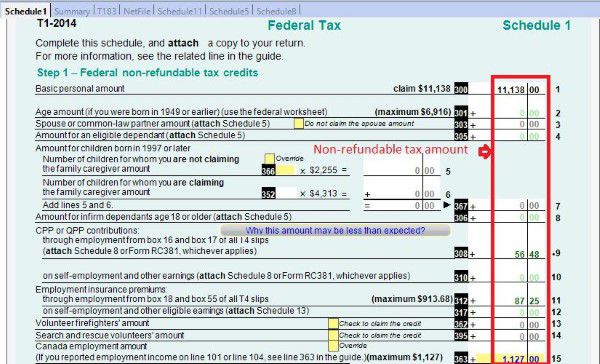

Find Fresh Content Updated Daily For Tax refund check dates. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. You can qualify for a tax credit even if you dont owe any taxes.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. 2 For example if you owed 10000 in taxes a 3000 tax credit would lower what you owe to 7000. Brian Kemp says special state income tax refunds will begin this week although it could be early August before everyone who filed a return before the April deadline will get paid.

Single taxpayers who lost work in 2020 could see extra refund money soonest. Unemployment 10200 tax break. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

A tax credit reduces how much you need to pay in taxes or may even provide a refund. Refunds are generally issued within 21 days of when you electronically filed your tax return or 42 days of when you filed paper returns. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

This means if it took the IRS the full 21 days to issue your check and your bank five days to post it you could be waiting a total of 26. Tax credits reduce your final tax bill on a dollar-for-dollar basis. The unemployment tax break is a special type of refund that allows you to deduct up to 20400 of unemployment benefits from your earnings.

For example with refunds going into your bank account via direct deposit it could take an additional five days for your bank to post the money to your account. The IRS tax refund schedule dates according to the IRS are 21 days for e-filed tax returns and 6 to 8 weeks for paper returns. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

Typically taxpayers who file their returns electronically can expect to receive their tax refund within three weeks or 21 days. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

When To Expect Your 2022 Irs Income Tax Refund

Tax Refund Stimulus Help Facebook

Here S How Long It Will Take To Get Your Tax Refund In 2022 Cbs News

United States Is My Tax Return Refund Unsually Late Personal Finance Money Stack Exchange

Tax Course 8 Understand Individual Income Tax Return

Child Tax Credit Schedule 8812 H R Block

2022 Irs Tax Refund Dates When To Expect Your Refund

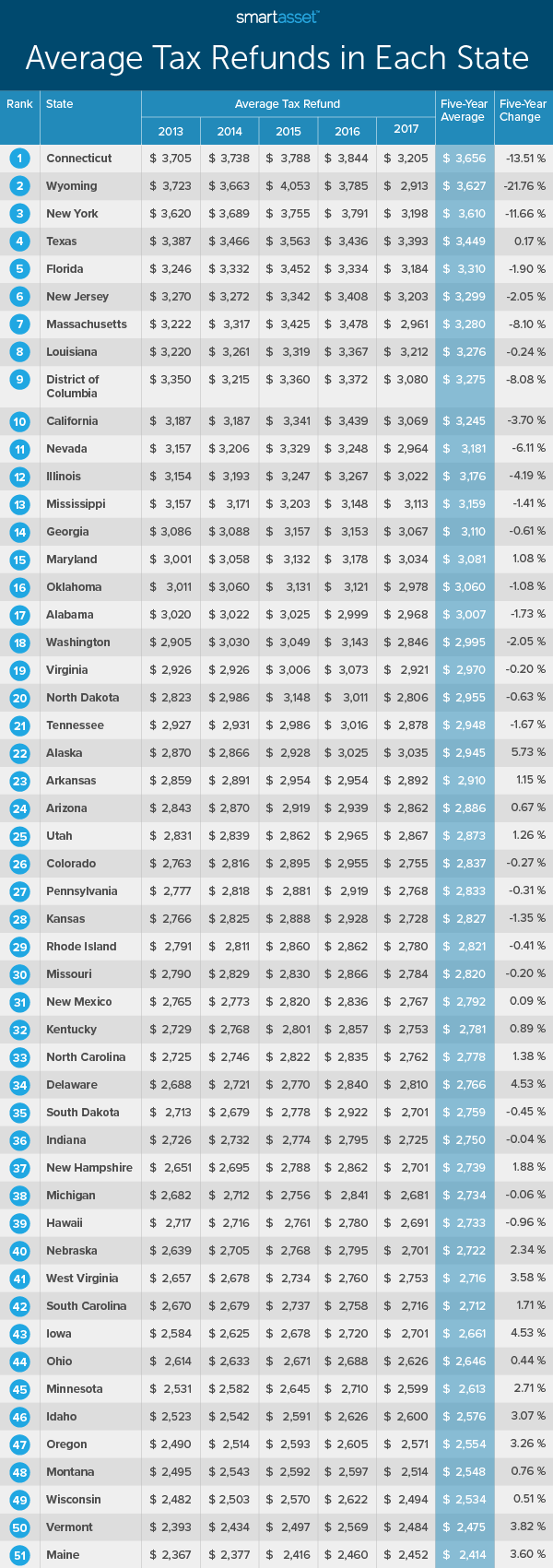

Tax Refunds In America And Their Hidden Cost 2020 Edition

If As Of Date On Transcript Is Based On Something The Irs Did In The Past Why Do I Have An As Of Date That S In The Future 3 15 2021 R Irs

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds In America And Their Hidden Cost 2020 Edition

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021